BY KAYODE ADEBIYI

Many key events defined the outgoing year for Nigeria, affecting individuals, groups, and the nation at large.

Looking back, some Nigerians recall 2025 with mixed memories, as the high cost of living persisted, largely due to major economic reforms.

Others, however, noted glimmers of hope, suggesting that the worst of the economic pressures may be easing.

On the domestic front, Nigeria experienced cautious economic recovery, with macroeconomic indicators showing modest improvement.

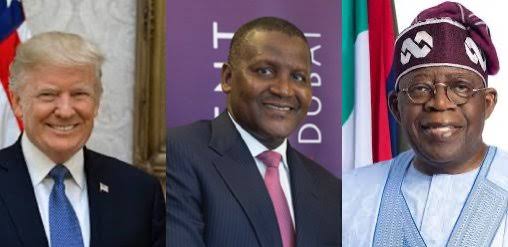

Industrial developments, most notably the ongoing impact of the Dangote Refinery, reshaped energy markets and fuel supply chains.

At the same time, the global stage remained turbulent, with trade tensions, geopolitical shifts, and international events influencing domestic policy and public sentiment.

Cautious economic recovery’, resurgence of insurgency.

If 2024 was the year Nigeria had to swallow the bitter pill of economic reforms, some say 2025 was a year of “cautious economic recovery,” characterised by stabilising macroeconomic indicators.

Statistics show that the economy grew by 3.98 per cent in Q3 2025, a slight increase from 2024 but still below the government’s 4.6 per cent target.

Also, headline inflation saw a significant decline. By June 2025, it dropped to 22.22 per cent (down from over 34 per cent in2024), according to the National Bureau of Statistics (NBS).

However, food inflation remained a primary concern for many households, as over 33 million people were projected to face “crisis-level” food insecurity during the 2025 lean season, a 32 per cent increase from 2024.

Mass kidnappings and insurgency saw many killed by terrorists and bandits, including in Kwara.

November 2025 saw over 200 students and teachers taken from a school in Niger, leading to the temporary closure of thousands of schools across the North-West.

Between June and October, flash floods affected 115 local governments, displacing 129,000 people and destroying roughly 761,000 hectares of cropland.

Dangote’s many battles with oil marketers, regulators.

After beginning operations in 2024, the Dangote Refinery was initially forced to source crude from international markets following the dispute with the NNPCL over a crude supply deal.

For the first time in decades, Nigeria saw a dramatic collapse in its reliance on foreign fuel, but after the supply disagreement was resolved, another crisis regarding marketing.